When you include McLeod Health Foundation in your will/trust or as a beneficiary of a retirement plan or life insurance policy, McLeod Health Foundation will invest the funds in the McLeod Health Foundation Endowment with other previous gifts. A team of investment professionals manages the entire endowment. Separate fund accounting is maintained to identify and keep separate funds for specific purposes.

Each year, McLeod Health Foundation receives a distribution of approximately 5% of the value of the fund. If the endowment earns an average of 8%, the additional 3% remains in the fund; thus your original gift to McLeod Health Foundation will increase over time. The distributions from funds restricted to specific purposes are dedicated only to those purposes.

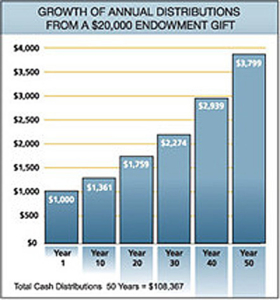

The chart at above illustrates the growth of the annual distributions to McLeod Health Foundation of an endowment gift under these assumptions. The 3% net growth in the fund each year means the following year there is a greater amount available to McLeod Health Foundation. Looking at the chart, you can see that in the tenth year the fund has grown to the point where it is able to provide $1,361 to McLeod Health Foundation. Each year it will continue to grow. In year 50 it will be able to provide $3,799 dollars to McLeod Health Foundation.

All told, over the fifty years we have charted, your endowment gift of $20,000 will have distributed a total of $108,367 in annual distributions to McLeod Health Foundation and have grown to almost $76,000, continuing to provide needed support. Of course, this is based on the assumptions we outlined in the opening paragraph; that the fund grows at 8% each year and pays out 5% to McLeod Health Foundation leaving 3% additional in the fund each year.

Your original gift is never depleted; it provides annual support each year into the future.

The chart above illustrates how a gift of $20,000 to the McLeod Health Foundation Endowment will grow, providing greater annual distributions to McLeod Health Foundation. The illustration assumes the same average investment rate of return of 8%, which is not a guarantee, and annual distribution to McLeod Health Foundation of approximately 5% that we used above.